Are Home Improvement Loans Tax Deductible? Not Always

Table of Content

If you don't have a from the lender, the interest is not deductible. If you "did" receive something reporting the interest to you, that was not a 1098, then check the document. You're looking for phrases like "substitute 1098" or "in lieu of a 1098". Interest reporting documents with either of those phrases on it, indicates that you can deduct the interest reported on said document. To deduct interest from loan payments, you’ll need to itemize the deductions using a the IRS Form 1040 or 1040-sr.

For you to take a home mortgage interest deduction, your debt must be secured by a qualified home. A home includes a house, condominium, cooperative, mobile home, house trailer, boat, or similar property that has sleeping, cooking, and toilet facilities. If you completed a home improvement project using a home equity loan or HELOC, including RenoFi Home Equity Loans and RenoFi HELOCs, you may be eligible for home mortgage-interest deductions. Before the Tax Cuts and Jobs Act of 2017, all home equity loans were tax deductible, no matter what. Home equity loans are no longer deductible if the loan is being used for personal items like vacations, tuition, credit card debt, cars, clothing, etc. According to the IRS, for you to take a home mortgage interest deduction, your debt must be secured by a qualified home.

Can You Include Closing Costs In Loan

Add the average balances together and enter the total on line 12. 13.Enter the total amount of interest that you paid on the loans from line 12. See the line 13 instructions13.14.Divide the amount on line 11 by the amount on line 12. Enter the result as a decimal amount 14.× .15.Multiply the amount on line 13 by the decimal amount on line 14. Otherwise, you can use Table 1 to determine your qualified loan limit and deductible home mortgage interest.

For instance, if you use a room in your home as your office and have shelving installed by a professional carpenter, you can deduct 100% of this cost. Improvements you make to your entire home are also depreciable. For instance, a new roof would qualify, whereas patching a leaking roof would not.

What is the home mortgage-interest deduction?

Any secured debt you use to refinance home acquisition debt is treated as home acquisition debt. However, the new debt will qualify as home acquisition debt only up to the amount of the balance of the old mortgage principal just before the refinancing. Any additional debt not used to buy, build, or substantially improve a qualified home isn't home acquisition debt. See Part II. Limits on Home Mortgage Interest Deduction, later. However, the statement shouldn't show any interest that was paid for you by a government agency.

Walser also notes that some energy credits will start shrinking. For instance, solar installation credits will drop to 26% for tax year 2020, and 22% for tax year 2021. These reductions could speed up homeowners energy upgrade investments because both construction start date and placed in service date impact the amount of credit. The loan or line of credit must be used to buy, build or substantially improve your home. A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

When Can you Deduct Home Improvement Loans?

He has been writing since 2009 and has been published by "Quicken," "TurboTax," and "The Motley Fool." SuperMoney has made it easy to apply with all of them with one simple form via theSuperMoney loan offer engine. It’s an established business practice to pay points in the area where the loan was made.

Through April 30, they made home mortgage interest payments of $1,220. The settlement sheet for the sale of the home showed $50 interest for the 6-day period in May up to, but not including, the date of sale. Their mortgage interest deduction is $1,270 ($1,220 + $50). In 2017, the Tax Cuts and Job Act changed the individual income tax dramatically.

On November 21, John took out a $36,000 mortgage that was secured by the home. The mortgage can be treated as used to build the home because it was taken out within 90 days after the home was completed. The entire mortgage qualifies as home acquisition debt because it wasn't more than the expenses incurred within the period beginning 24 months before the home was completed.

But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest for the Current Year See the Table 1 Instructions.Qualified loan limit, Table 1. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest for the Current Year See the Table 1 Instructions.Wraparound mortgages, Wraparound mortgage. Grandfathered debt, Fully deductible interest., Grandfathered DebtGround rents, Redeemable ground rents.

It’s a good idea to keep track of all repairs and renovations made in your home. These home improvementsare added to the tax basis of your house. If you are on the fence about a property remodel, then borrowing against your home just to take advantage of deducting the interest is probably not the best choice for you. Interest on home equity loans has traditionally been fully tax-deductible.

Deduct home mortgage interest that wasn't reported to you on Form 1098 on Schedule A , line 8b. If you paid home mortgage interest to the person from whom you bought your home, show that person's name, address, and taxpayer identification number on the dotted lines next to line 8b. The seller must give you this number and you must give the seller your TIN. A Form W-9, Request for Taxpayer Identification Number and Certification, can be used for this purpose. Failure to meet any of these requirements may result in a $50 penalty for each failure.

Taking out a home equity loan therefore means putting the borrowers home at risk. If the borrower fails to pay back the loan, the lender can foreclose and sell the home to pay off the debt. The impact of the change varies according to where you live and will have the greatest impact on homeowners living in states with high income and property taxes , says Walser. The Tax Cuts and Jobs Act changes the rules for deducting interest on home loans. Most homeowners will be unaffected because favorable grandfather provisions will keep the prior-law rules for home acquisition debt in place for them.

You may then use any reasonable method to allocate the remaining balance of the payments to real property taxes, mortgage insurance premiums, and principal. However, you're not required to use this special method to figure your deduction for mortgage interest and real estate taxes on your main home. The points werent paid to replace other closing costs such as title or appraisal feesState and local taxes. The current tax laws allow you to deduct state and local taxes of up to $10,000 for single taxpayers and married couples that file jointly.

She can figure her average balance for the year by adding her monthly average balances and dividing the total by 12. His average balance using this method is $27,778, figured as follows. If you took out a mortgage on your home before October 14, 1987, or you refinanced such a mortgage, it may qualify as grandfathered debt.

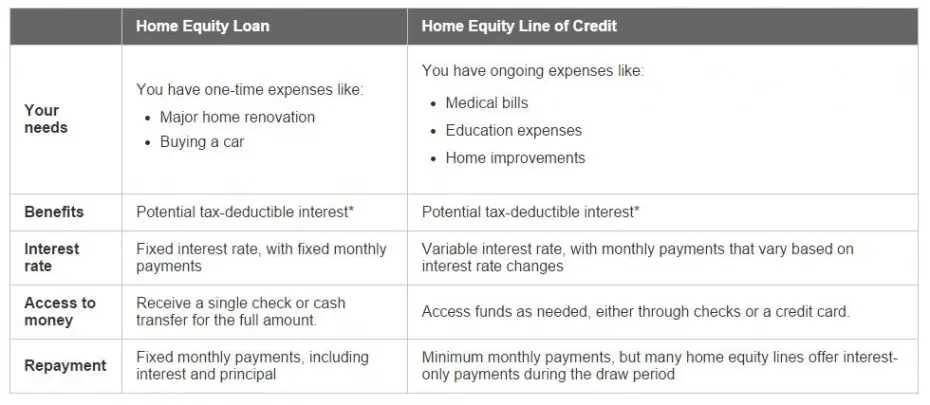

If you are already itemizing your deductions, then choosing a HELOC or a home equity loan over something like a personal loan so that you can deduct the interest may make the most financial sense for you. Keep in mind that the attractiveness of a HELOC—and its deductibility—can change if interest rates rise. Personal loans base eligibility on your credit and income, so you don’t need to own property worth a certain amount of money to take one out.

Comments

Post a Comment